Hasbro’s annual earnings came out this week, so I took a look. It is truly staggering how much Wizards of the Coast has changed the company since they were acquired; when looking at unadjusted earnings the Wizards of the Coast and Digital Games division was the only one that turned a profit in the entire company. Not only that, but Wizards is responsible for roughly 47% of the entire company’s revenue and over 90% of all revenue growth over the last year. That’s over 2 billion dollars in revenue; roughly $1.7 billion is attributable to Magic: The Gathering and the rest is attributable to Dungeons and Dragons.

Dungeons and Dragons is obviously the largest, most popular roleplaying game, but $400 million in revenue is staggering. If this was all books, it would be eight million copies. It’s not all books of course; one of the reasons D&D is growing (though perhaps not as fast as Magic is) is the continued expansion of digital services like D&D Beyond, products with high margins and minimal variable costs. This is the future, not because it makes for a better gaming experience, but because it makes for a better balance sheet.

I know I’ve said many, many times before that D&D has an outsized impact on the market, but I want to make it clear what I mean. I’ve broken the RPG publishing industry into five tiers: the first four are categorized by revenue, each an entire order of magnitude smaller than the last. The final tier is everyone else who’s more than an order of magnitude smaller than the previous tier. The tiers are named by approximate revenue values: 500 million, 50 million, 5 million, and 0.5 million, with Everyone Else at the end.

~$500 million annual: D&D

If we’re going solely by corporate results, Hasbro is another order of magnitude higher than this tier, clearing nearly five billion in revenue in 2025. At this size, though, D&D can operate like an independent entity even if we only count its independently achieved revenue. More than just being the biggest TTRPG by far, D&D shows how staggeringly dominant Wizards of the Coast is in the hobby games world by significantly trailing the company’s largest product, Magic: the Gathering. Magic: the Gathering made roughly $1.7 billion in 2025, making it almost certainly the largest TCG in the world; in contrast the entire revenue of The Pokemon Company in 2023, video games, card games and all, was less than $2 billion. That means that, as Wizards is largely built of two brands, Dungeons and Dragons cleared around $460 million in revenue in 2025, all by itself (note: this number is likely somewhat lower, please see the comments. Attributable revenue in the $300-350m range doesn’t appreciably change the conclusions of the article. -AM).

When I say that D&D exists on an entirely different plane from other RPGs, this is what I mean. Revenue numbers are conservatively 10x higher than the next closest competitor (who sells two game lines). With the amount of brand recognition available, revenue can come from any range of secondary sources, not the least of which are minis, official dice, and tie-in digital services. Any doom and gloom about the revised rulebooks ends up being irrelevant when they make enough money to hilariously outclass every other game on the market.

What does hilariously outclass mean? In 2025 Dungeons and Dragons likely took in somewhere in the neighborhood of ten times as much money as every single TTRPG crowdfunding campaign from that year combined.

One interesting comparable to the D&D brand is Games Workshop. Games Workshop doesn’t publish RPGs (Warhammer RPGs are licensed to other companies, currently Cubicle 7), but their business takes in about the same amount of revenue as D&D (a bit more, their revenue figure is in pounds sterling). That does mean that Games Workshop as a hobby games entity is, despite its high profile, a fraction of the size of Wizards of the Coast.

~$50 million annual: Paizo

Paizo is the only headline entry on this list that doesn’t have a verified revenue figure: Hasbro is publicly traded and both Steve Jackson Games and Evil Hat disclose their revenues voluntarily. That said, online estimates that put Paizo’s revenue at between $35 and $40 million make sense for the company putting out the perennially number two TTRPG, Pathfinder. Getting to number two as well as getting into another rarefied circle of the RPG hobby takes both luck and skill. Paizo head Lisa Stevens got her start all the way back as the editor for Lion Rampant in the 1980s, and her industry experience shone through when D&D Fourth Edition nearly sounded the death knell for Paizo by forcing the cancellation of both Dragon and Dungeon magazines, the products which Paizo was literally founded to produce. The pivot to Pathfinder was a calculated risk but a success, and the company continues on by serving its fans with a constant stream of products. What’s a constant stream? There are already 17 upcoming releases for Pathfinder and 9 for Starfinder set to publish in 2026, and that doesn’t include special editions of rulebooks or adventures. Paizo has pushed its way into the second tier with talent, grit, and sheer volume, and there’s a reason no other company with an RPG-exclusive catalog comes close.

There are a couple of companies that may make it into double-digit millions territory with revenue, though neither of them have verifiable revenues at that level and even estimates come out notably smaller than Paizo. Mongoose Publishing, current shepherds of the Traveller and Paranoia lines, has revenue estimates ranging from $8 to $22 million, too wide a range to glean much specific information from. However, the annual State of the Mongoose report describes the company having the necessary finances to buy out the licenses to Traveller, 2300AD, and Twilight:2000, as well as pay generous bonuses to their staff. A double-digit million revenue figure is certainly possible based on how well the company is doing qualitatively. Also in the hypothetical double-digit million club is Chaosium, with revenue estimates ranging from $1 to $26 million (in the market intelligence industry, this is called an NFC or ‘no fucking clue’ estimate). Chaosium owns several renowned game lines, including Call of Cthulhu and RuneQuest. They are also, in recent times at least, known for haphazard financial management and more brushes with disaster than their seeming bestseller status would indicate. Given the popularity of Call of Cthulhu and RuneQuest the upper range of estimates is certainly possible, but given what’s known about their financial management in the wake of Call of Cthulhu 7e actual company revenues since about 2015 are really anybody’s guess.

~$5 million annual: Steve Jackson Games

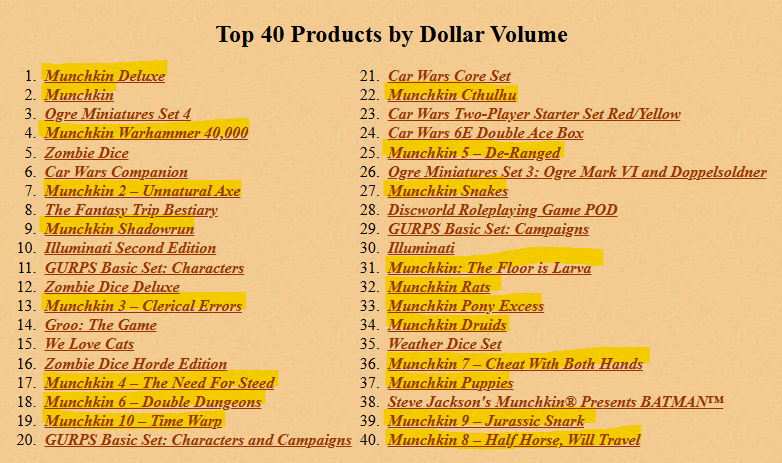

Steve Jackson Games disclosed it had generated around $3.5 million in revenue in their 2024 Report to the Stakeholders, though they couched it as ‘roughly the same as last year’ (and indeed the actual number was listed in the 2023 edition of the report). Steve Jackson Games is somewhat like Wizards of the Coast, not in size but rather in the fact that more revenue comes from other hobby games besides RPGs. Munchkin is the game Steve Jackson Games is best known for, but others like Ogre, Zombie Dice, and Illuminati do grace their top products list.

While the company’s results are dominated by card games, key RPG products still make a strong showing, with both The Fantasy Trip and GURPS having core books show up in the top products list. Steve Jackson Games does practice some of the same volume strategy as Paizo, but given the age of essentially all of these products the aim is more to maintain legacy lines than provide a stream of content for a growing fanbase. The current crowdfunding of Munchkin 2e may prove to be a shot in the arm for the business, but at around $300k in the Backerkit campaign now, it’s not looking to be a gamechanger. Munchkin 2e and GURPS 4e Revised (likely coming later this year) will help sustain but not grow the business. That said, with headwinds around tariffs and other obstacles from this past year, if Report to the Stakeholders 2025 says that revenue was ‘same as last year’, that will be a success.

This single-digit millions tier is the most heavily populated tier when it comes to known publishers. Free League, Cubicle 7, Onyx Path, and Magpie are firmly in this category, while others like Modiphius and R. Talsorian are effectively in this category with asterisks (Modiphius makes double digit millions in revenue but a good chunk of that comes from their distribution business, and RTal makes single digit millions from RPGs but has licensing agreements to CDPR for Cyberpunk which likely create additional revenue). If you know of a publisher and they are able to support multiple games or at least one substantial game line, they’re in here.

~$0.5 million annual: Evil Hat Productions

Evil Hat actually shares their quarterly sales spreadsheets on Bluesky, so you too can look and confirm that in Q4 2025 they made roughly $150,000 in product sales; you can also check through the rest of the quarters and see that the company netted out about $600,000 in 2025. This is the point where we’ve shifted into ‘indie’, though Fate is arguably one of the most successful indies of the 2010s at least on a financial basis. Still, it’s hard to run a company on this scale of revenue. You’re not really paying many salaries, and indeed those at the top of Evil Hat are doing it in addition to other work. This is also a level where you’ll see the most successful singular designers, though clearing six figures of revenue doesn’t translate to a six figure salary. Rather, half a million dollars, or in the neighborhood of what Evil Hat makes in total, is going to pay low six figures to one person, unless that person is somehow generating half a million dollars of revenue entirely on digital sales and enjoying the higher margins that entails.

Generally speaking, this is also where most Kickstarter ‘breakouts’ are going to be; it takes multiple million-plus Kickstarters to build enough momentum and product tail to equate to even hundreds of thousands of dollars in revenue, let alone into that million-plus arena. For Tuesday Knight Games, as one example, to parlay their $1.4 million Kickstarter for Mothership 1e into a consistent seven figure revenue stream, they would have had to sell the equivalent of the Kickstarter’s volume every year for at least four of the last five years. As much as I think that Mothership has been successful, that almost certainly did not happen. Still, Mothership is a great example of what games look like at this revenue level; you can be eminently successful and build a great fanbase, but if you want to do literally anything other than just pay yourself to design the game, you need crowdfunding or some other form of financing.

Everyone else

Needless to say, the vast majority of game designers don’t clear $100,000 in revenue on their games. Unfortunately that means that, given the timelines and margins of even modestly successful products, the vast majority of game designers aren’t able to pay themselves minimum wage, either. When you see a Kickstarter campaign that clears $100,000 in revenue once, that’s already going to be closer to $50-60,000 of annual revenue once you amortize it over a realistic fulfillment time period (another thing many game designers will not clear). If you’re clearing $100,000, you’re also usually paying for art, layout, editing, and printing. Generally speaking, if you aren’t Tuesday Knight Games or someone else with a known product and a good reputation, you’ll typically make no more than 10-15% of your Kickstarter revenue in future product sales after the campaign is completed. While rates and amounts of outside support vary, that generally means that a $100,000 Kickstarter will net you maybe a $50,000 salary (with zero benefits) if you do one or two a year every year for the next twenty years (and have them all make at least six figures). At the average ticket size for a Kickstarter, $100,000 is somewhere between one and two thousand copies. If your game is 400 pages long, you’ve sold the equivalent of one paragraph off of one page of every D&D book sold that year.

$100,000 Kickstarters are profitable, let me be clear: Making that much money from a single game should change your trajectory as a designer. That said, it’s the start of a career, and not necessarily a start which will immediately let you quit your day job. Kevin Crawford is likely one of the most successful single-person operations in RPGs, and he has run 13 Kickstarter campaigns over the span of 14 years. As much as that can net you a living, it absolutely cannot net you enough extra money to be able to self-capitalize your next book. And as we look back up the tiers of revenue, self-capitalization is still a problem. Sure, that problem does go away…around Paizo levels. That only leaves two companies in the entire hobby with enough money to consistently fund their own publication.

The whole intent of this exercise is context. If you’re looking at topline company metrics, the #3 RPG publisher is no more than 1/200 the size of the #1 RPG publisher. If you were to make a list of the top 30 publishers by revenue, you could probably rename it “the complete list of all RPG publishers who can afford full-time staff”. This hobby is small, and hobby fans can be forgiven for noticing that taking down D&D to make way for ten more Paizos (or thirty more Mongooses, or a hundred more Magpies) is significantly more likely to happen than the hobby growing the 300% or so it would take to get that revenue share organically.

The situation at the bottom is never likely to change; there will always be more aspiring designers than gamers who will actually consume those games. Crowdfunding means that designers have a better chance than ever before to get those games into people’s hands, it’s probably the biggest gamechanger in the space since the PDF. So I don’t think that people take issue with knowing the bottom’s hard. Knowing that the top is so choked out, though, that’s rough, especially when it’s choked out by a company that has always concerned itself more with marketing than innovation. I know fans found ‘Maybe…Don’t Play D&D’ to be a tough pill to swallow, but we have to be real about what this industry looks like. This is a company that is aiming to dominate, not foster, and one that aims to capitalize its fans, not support them. There was already an announced Harry Potter collab in the Hasbro year-end financials, with the press release including a reference to ‘role play’ that’s disconcerting. How many more ‘fuck yous’ from Hasbro will it take? Likely too many. We have famous GMs blaming society’s ills on capitalism in one sequence and giving an absolute bootlick of free advertising to Hasbro in the next, so I have to assume most of the hobby doesn’t really care. Oh well. Enjoy the official cookbooks, the next movie, and the AI-generated video games. Wizards of the Coast made 40% more money on tabletop games in 2025 than in 2024, and their plan to make even more doesn’t involve making the game better.

Hasbro’s FY 2025 earnings report is available here. Steve Jackson Games’ 2024 Report to the Stakeholders is available here. Evil Hat’s quarterly earnings reports are available here.

This article was edited in response to a confirmation that there will not be a Harry Potter appearance in Magic: The Gathering: https://kotaku.com/magic-not-planning-harry-potter-crossover-despite-parent-company-announcing-major-deal-2000667292

Like what Cannibal Halfling Gaming is doing and want to help us bring games and gamers together? First, you can follow me @levelonewonk.bsky.social for RPG commentary, relevant retweets, and maybe some rambling. You can also find our Discord channel and drop in to chat with our authors and get every new post as it comes out. You can travel to DriveThruRPG through one of our fine and elegantly-crafted links, which generates credit that lets us get more games to work with! Finally, you can support us directly on Patreon, which lets us cover costs, pay our contributors, and save up for projects. Thanks for reading!

Thanks for this, it’s very interesting to have this whole picture.

Do you have any ideas where Edge would be (Star Wars RPG) ?

LikeLike

Great question. I feel it’s worth noting that in its heyday, Fantasy Flight Games may have been a second member of the ~$50 million tier; the Star Wars RPG sold incredibly well in traditional channels (number three in the ICv2 rankings for years) and the company had a large catalog of board games which could prop up the RPGs in the same way Magic does for Wizards or Munchkin does for Steve Jackson. Once Asmodee reorganized their tabletop portfolio and placed all the RPG properties in Edge, things looked a little different.

Asmodee itself is a large corporation, clearing 1.2-1.5 billion euro annually in revenue. That said, most of that revenue comes from distribution, their ‘games published by partners’ vertical. Inhouse is a bit more lumpy but revenues appear to be around 400 million euro, or roughly the size of Dungeons and Dragons. The question of course is how much of that is RPGs, and even the fact that Asmodee pulled RPGs out of Fantasy Flight is an indication that the company thought they were either getting not the right amount of resources or the wrong kind of resources. If you go to Asmodee’s Annual Meeting presentation, you’ll note they attribute 51% of revenue to TCGs, 39% to board games, and 10% to ‘other categories’. Unfortunately, ‘other’ also includes things like digital adaptations of board games, so we can’t attribute all of it to TTRPGs. This is all a roundabout way of saying that Edge Studio could be in the double-digit millions club…but as they’re likely a smaller contributor to a roughly 40 million euro annual segment (and it may be smaller than that, I’m only assuming that ‘other’ splits out proportionally between inhouse and published games), meaning that they’re almost certainly going to be in the ~$5 million tier even if their actual revenues may be above $10 million.

When you get into interdependencies and big parents things get complicated…I opted not to get into either White Wolf or Marvel because they end up being incidental subsidiaries of corporations in entirely different industries.

LikeLike

Almost forgot…if you want to take a look at the data yourself, it’s here: https://corporate.asmodee.com/investor-relations

LikeLike

Over the last couple of years, Wizards of the Coast has developed a third major revenue stream: digital licensing revenue. This started with BG3 and continues with Monopoly Go. The latest earnings report states that WotC earned $168M for the year from Monopoly Go payments from Scopely. So D&D revenue is more in the $250-$300M range, rather than $460M.

LikeLike

Thanks for pointing this out. Looking through it is likely that revenue attributable to D&D is closer to the $300m range, though the missing link in all this is how Magic breaks out across tabletop and digital. There’s also (though this doesn’t speak directly to the Monopoly Go point) some ambiguity in what ‘Hasbro Gaming’ includes, a $2.7B segment which includes all of Wizards/Digital but isn’t further explained in the financial filings.

I took a look at Q3 compared to Q4, which provided some more numbers around Monopoly Go as well as Magic; net contribution from D&D in Q4 was around $86M, which translates to a going-forward projected annual revenue contribution of $350M (and growing). Still a haircut from the simpler analysis, but also still the largest TTRPG property by a factor of ten and still realistically a further tier above everyone else thanks to Hasbro’s total revenue of close to $5 billion.

LikeLike

Fred from Evil Hat here, in case you’d like some context for us: https://bsky.app/profile/deadlyfredly.bsky.social/post/3meoc7avizc2l

LikeLiked by 2 people

Thanks, Fred. I really appreciate the transparency that you and the Evil Hat team are always able to provide.

LikeLiked by 1 person

Atlas Games had an $841k Kickstarter, which at least for me is reason to hope that they’ll become a contender again. But it also feels like if a few of these companies merged they’d all be better off….

LikeLike

Atlas Games also has a pretty healthy board game line, which I’m sure can help smooth out the peaks and valleys of crowdfund financing. I did a brief look and there’s nothing to really indicate they’re out of the single-digit millions middle tier, though personally I hope the steward of both Ars Magica and Unknown Armies keeps doing well.

LikeLike

@cannibalhalflinggaming.com Very interesting, didn't think good old SJGames was still playing in the top ten or close to it nowadays. All the more remarkable since they haven't jumped the a-new-edition every-decade bandwagon.

Also surprised WotC is such a big part of Hasbro's revenue, but I guess I never really knew what the company did except for My Little Pony.

LikeLike

Remote Reply

Original Comment URL

Your Profile

@cannibalhalflinggaming.com the absolute hammering of Mulligan in that was hilarious.

LikeLike

Remote Reply

Original Comment URL

Your Profile

The Arcane Library (Shadowdark) had a 2025 Kickstarter that will close this month at $3 million. They probably won’t have another like that for awhile though. Current distribution is spotty but expanding globally, due to that Kickstarter fulfillment this year. They have a great convention presence and demand for an indy publisher. I’m curious where they stack up.

LikeLike